Market Navigator for the Month Ending August 31, 2025

August was another strong month for markets, with major U.S. stock indices reaching new highs despite some early volatility. Investor optimism was fueled by solid corporate earnings, falling interest rates, and growing expectations for a Federal Reserve rate cut in September. While economic data showed some signs of slowing—particularly in the labor market—overall market fundamentals remained supportive as summer comes to a close.

1. Beyond the Headlines: Markets Continued to Climb in August

2. Interest Rate Expectations Shift After Fed Comments

3. Jobs Report Shows Signs of a Slowing Labor Market

4. Solid Foundation in Place for the Fall

Beyond the Headlines: Markets Continued to Climb in August

Markets had another strong month in August, even though there were some ups and downs early on. The S&P 500 gained 2.03 percent for the month while the Dow Jones Industrial Average rose 3.42 percent, and the Nasdaq Composite gained 1.65 percent. These gains pushed markets to new record highs, showing that investors still feel confident about U.S. stocks.

undamental factors drove returns for the month, as improved earnings growth supported U.S. stocks. With more than 96 percent of companies having reported earnings, the average growth rate for the S&P 500 in the second quarter stands at 10.7 percent. This is well above analyst estimates at the start of earnings season for a modest 2.8 percent increase, and it signals continued strong performance for

U.S. companies.

Technical factors were supportive as well. All three major U.S. indices spent the entire month well above their respective 200-day moving averages. This is a widely followed technical indicator, and the continued support in August was another positive sign for investors.

Stocks outside the U.S. also did well, with international markets ending the month in positive territory. The MSCI EAFE Index gained 4.26 percent in August while the MSCI Emerging Markets Index was up 1.47 percent. Technical factors were supportive of foreign stocks as well during the month.

Even bonds, which often move in the opposite direction of stocks, saw gains as short-term interest rates fell. The Bloomberg U.S. Aggregate Bond Index was up 1.2 percent for the month. The Bloomberg U.S. Corporate High Yield Index was up a solid 1.25 percent as well. High-yield credit spreads continued to grind tighter in August and now sit near levels last seen at the start of the year.

Interest Rate Expectations Shift After Fed Comments

The primary driver of the interest rate drop was a speech by Federal Reserve Chair Jerome Powell at the annual Jackson Hole meeting in late August. He hinted that the Fed might lower interest rates at its next meeting in September. Investors took that as a strong signal, and many now expect at least one rate cut this fall—possibly even two before year-end.

This is a marked change from the start of August, when traders were pricing in a roughly 50/50 chance of a rate cut in September. Powell’s dovish comments, along with signs of potential weakness in the labor market, caused a meaningful change to investor expectations.

Takeaway:

· Short-term interest rates fell in August, due to rising investor expectations for a September

rate cut.

Jobs Report Shows Signs of a Slowing Labor Market

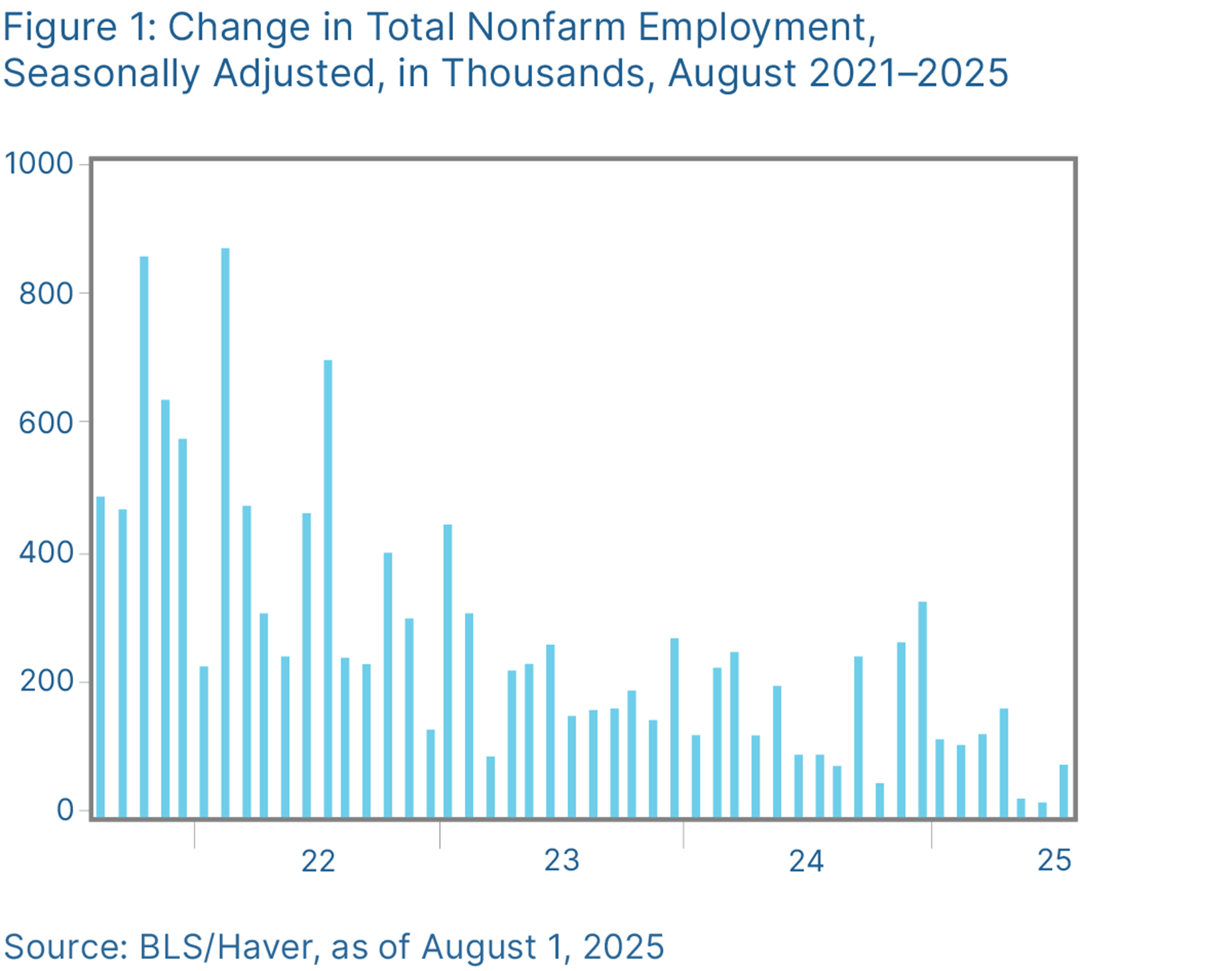

While the market performance and fundamental improvements were welcome in August, the latest economic data was more mixed. The July jobs report showed that hiring slowed down over the summer. Only 73,000 new jobs were added in July, which is much lower than usual.

On top of that, the government revised its earlier estimates for May and June, showing that fewer jobs were added in those months than originally thought. As seen in Figure 1, this represents a notable slowdown in hiring compared to earlier in the year.

While the economy has been a solid foundation for the market so far this year, this slowdown in hiring could be an early warning sign of a shift and could lead to lower rates from the Fed.

Takeaway:

· Hiring slowed notably during the summer, which could be a warning sign for the overall economy.

Solid Foundation in Place for the Fall

Beyond the job market, there are other risks investors should keep an eye on. Global tensions remain high, especially with ongoing conflicts in Ukraine and the Middle East. In the U.S., political uncertainty is still a factor, and it’s unclear how future policy decisions might affect the economy.

There are also some bigger-picture concerns as we head into the fall. Inflation could start rising again, and the Federal Reserve might change course depending on how the data looks. These are the kinds of issues that could create more market volatility in the months ahead.

Even with some warning signs, things are still looking fairly good as we wrap up the summer. Company earnings are strong, and the overall economic environment is still supportive of growth despite signs of a potential slowdown ahead. While there are risks to watch, the long-term outlook remains positive, with expectations for continued market gains and economic growth.

Given the potential for short-term uncertainty, a well-diversified portfolio remains the best path forward for most investors. If concerns remain, however, you should speak to your financial advisor to go over your financial plans.

Disclosure: This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.

Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. One basis point (bp) is equal to 1/100th of 1 percent, or 0.01 percent.

###

Pinnacle Private Wealth is located at 1001 Truman Street, Kimberly, WI 54136, and can be reached at (920) 326-1880. Securities and advisory services offered through Commonwealth Financial Network®, member FINRA/SIPC, a Registered Investment Adviser. Fixed insurance products and services are separate from and not offered through Commonwealth Financial Network®.

Authored by Chris Fasciano, chief market strategist, and Sam Millette, director, fixed income, at Commonwealth Financial Network®.

© 2025 Commonwealth Financial Network®